Introduction:

solar panel tax credit with new update 2024, His text break is often referred to as the solar tax credit; its official name is the residential clean energy tax credit. The credit Can cover expenses such as equipment and installation of solar panels but does not apply to structural work made solely to support panels. In some cases, tax credit is combined with state incentives and utility-funded programs that support clean energy.

As we move towards the latest future, the role of solar energy continues to grow in parallel. For those on the fence, there are substantial benefits to shifting to solar, and with residential solar panels being more affordable than ever—plus, installation rates becoming lower—it might be time to consider getting a solar energy system.

solar panel tax credit work with other incentives:

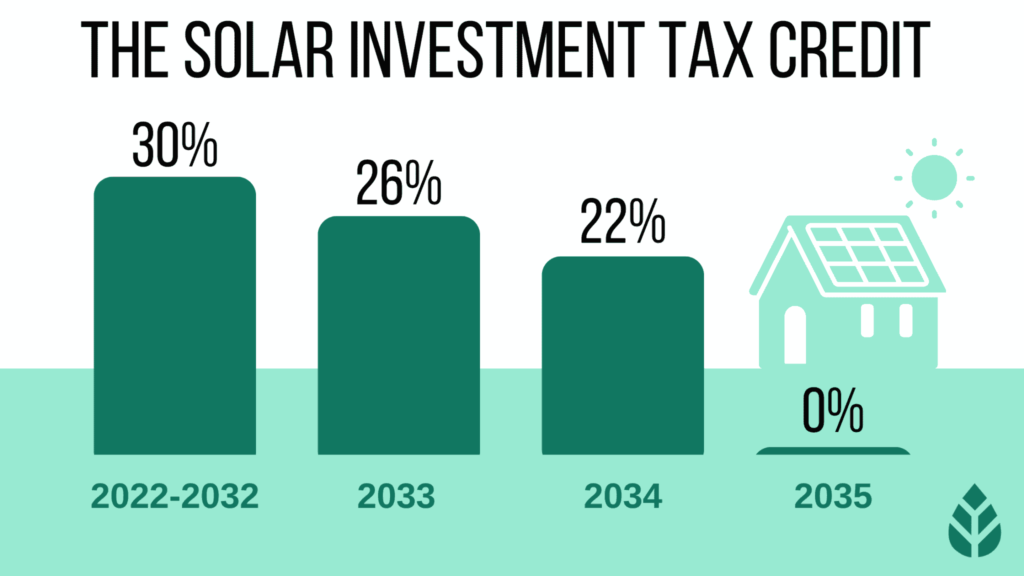

You can claim the tax credit if you receive other clean energy incentives for the same project, but that additional financial assistance might shrink the overall cost of your system for tax purposes. The amount available for solar panel tax credit can vary, depending on what you spend on the project and when you complete it.

To add, the Inflation Reduction Act, which became law in August 2022, introduced a generous tax credit for citizens looking to install rooftop solar panels on their homes. It’s known as the residential clean energy credit, and it can lend you that extra help in addition to the financing to help you power your home with solar energy. It’s a great way to offset some of the costs you incur while setting up your system.

solar panel tax residential clean energy credit:

The residential Clean Energy credit covers other types of renewable energy projects undertaken by homeowners. The cost of the labor assembly, or installation and wiring of the following properties also generally counts as qualifying expenses.

- Solar electric.

- Solar water heaters.

- Small wind energy.

- Biomass fuel.

- Fuel cells.

- Geothermal heat pumps.

solar panel tax credit FAQs:

Can solar panels save you money?

- Interested in understanding the impact solar can have on your home?

- Enter some basic information below, and we’ll instantly provide a free estimate of your energy savings.

What is the federal solar tax credit?

- The residential clean energy credit itself isn’t totally new.

- Previously called the investment tax credit, it’s been around for years but was expanded significantly under the Inflation Reduction Act.

- “It actually had been scaling down prior to the passing of the IRA,” said Gilbert Michaud, an assistant professor in the School of Environmental Sustainability at Loyola University Chicago.

- “As part of the Inflation Reduction Act, they just said, ‘We’re going to mitigate all the risk and the changes and uncertainty.'” and bump it back up.

- The credit now covers up to 30% of the cost of new, qualified clean energy improvements in your home, made between now and 2033.

- That includes projects like solar, but also water heaters, wind turbines, geothermal heat pumps, fuel cells, and battery storage technology.

How does the federal solar tax credit work?

- This federal incentive, while generous, won’t come directly in the form of cash in your pocket.

- Instead, it’ll reduce the amount of money you pay in federal taxes.

Conclusion:

Existing homes and new construction qualify. Both principal residences and second homes qualify. Rentals do not qualify. This system must be installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer.